Taking stock of FinEquity’s Growth and Influence

Each year we pause and take stock of all that’s unfolded in the previous year and review our commitments and priorities and set our sights on goals for the year to come. This year is no different, and we’d like to share those reflections with the members that have made FinEquity what it is today – a vibrant community of women’s financial inclusion and economic empowerment champions driving real and actionable change for women and men across the globe. Our heartfelt thanks to members whose involvement and annual survey responses helped inform this analysis.

Our numbers and diversity are growing

Our community, convened by CGAP, aims to connect members for dialogue, facilitate knowledge capture and sharing and ultimately influence industry outcomes for women’s empowerment through financial inclusion.

FinEquity now reaches over 4,200 members across 141 countries and more than 1,000 different institutions. Our broadest member base comes from individuals based in North America (32%) and Sub-Saharan Africa (31%), followed by South Asia (14%), and with a growing presence in Europe and Central Asia and the East Asia and the Pacific region.

In addition to geographic diversity, we’re pleased to see that our membership remains diverse across institution type as well. This diversity ensures representation of actors across the financial inclusion spectrum and offers valuable opportunities for dialogue and learning. We’ve seen a big increase in Financial Service Providers (FSPs) in our membership in the last year, signaling what we hope is a deepening of our engagement with those working directly with customers.

Members are leveraging FinEquity to connect, share, and learn

We leverage multiple platforms and hold targeted convenings to help members build professional connections and new partnerships that will benefit their work. Some 56% of annual member survey respondents indicated that participation in FinEquity contributed to enhancing connections with colleagues in the sector. About 36% said it was too early to tell, indicative of our recent membership growth and the need for more sustained interactions with new members.

“I work for a new/small organization so being connected with FinEquity has been a lifeline to interesting conversations and engagement with others working in the female financial inclusion space.”

As noted in previous pandemic years, the increase in virtual interactions continues to be a likely determinant of members’ perception of connection with the FinEquity community. The majority of members who shared or requested resources, information and advice on our platforms found the experience valuable (FinEquity Member Survey, 2022).

“Before FinEquity, connections were limited to conferences and periodic introductions. Now we can post needs, opportunities and virtual events to a community of practice beyond our scholarly networks.”

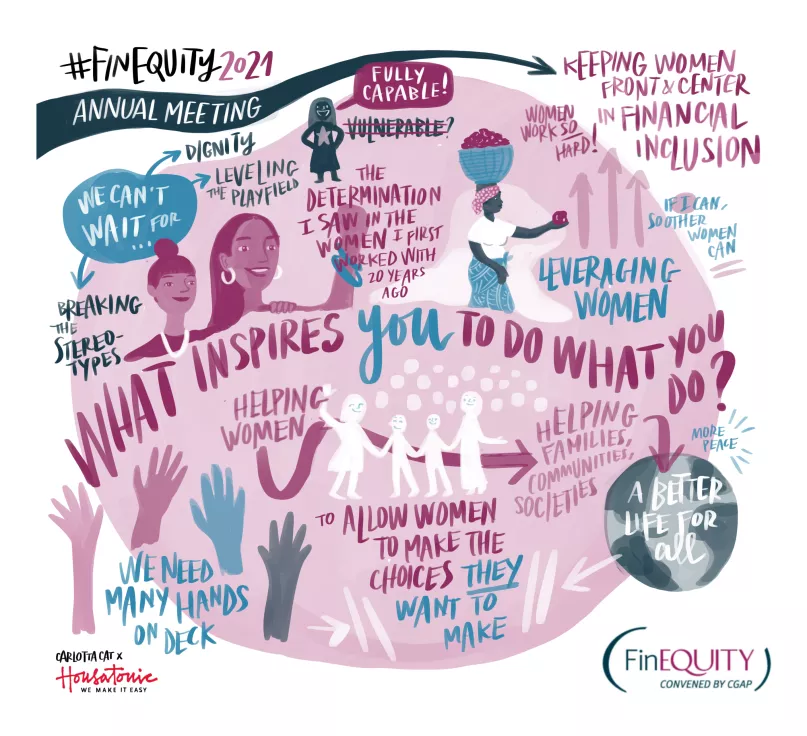

FinEquity also facilitates knowledge sharing and helps members showcase their work, learn about good practices, elicit technical feedback and explore opportunities for collaboration with a broad range of institutional actors. Over 2,700 individuals registered to join one of our 11 major learning events this year, which included our annual meeting. Additionally, 89% of respondents to the post-event satisfaction surveys saying that they learned something new with 72% saying they will likely apply the learnings in their work.

“We have learnt about the digital inclusion of women in different countries, their best practices and the challenges they face. We tried to implement these learnings for our vision of financial and digital inclusion of women.”

“I have leveraged concrete examples presented at webinars and the annual meeting in presentations and publications.”

FinEquity is an influential community of practice

FinEquity aims to influence practice and policy in the women’s financial inclusion and women’s economic empowerment sectors through expert input in industry initiatives, collective action on priority topics and regional collaborations.

In pursuit of this objective, we launched the WEE in WFI measurement collaborative this year (in partnership with Data2X and CGD) and are pleased to count on an engaged and enthusiastic core group of 20+ leading organizations in the sector. We also continued to facilitate the Social Norms Diagnostic Co-lab (an action research and peer learning initiative with six key partners) and are thrilled to have a Technical Advisory Committee composed of nine thought leaders and technical experts that help guide FinEquity’s strategy and amplify our influence.

Members continue to find that FinEquity’s learning agenda includes some of the most important priorities in the sector (82% of Survey respondents) and that we are an influential community of practice (90% of annual survey respondents).

“FinEquity always has a way of focusing on the critical issues that go beyond the headline topics like "gender" but rather gets into and prioritizes nuance which is so important.”

The rapid growth and deep engagement of our regional group FinEquityALC, with close to 2,000 active members collaborating and exchanging across five thematic working groups, is another testament to FinEquity’s influence.

Looking ahead

While we accomplished much in the last year and have seen clear markers of FinEquity’s continued importance as a convener and facilitator, there are certainly still areas, process-wise and topically, we can improve. Our members report issues like limited time, time zone differences and the difficulties of trying to deepen connections in a virtual world as challenges they face in their involvement in our community. Members have also mentioned additional topics they want to see included in our learning agenda – barriers to women's entrepreneurship, the intersection between gender, climate and financial inclusion, and gender mainstreaming through male participation.

We hear you! And we are excited to share a few initiatives that we hope to bring to you before the end of the year - the launch of a regional community of practice in Africa, and practical resource guides on priority industry topics such as collecting and using disaggregated data.