Microfinance institutions (MFIs) are key providers of financial services for low-income and marginalized populations around the world. From the origins of the microcredit movement in the 1970s to today’s digital world, MFIs have served millions of customers in developing countries, providing financing for microenterprises, supporting women’s empowerment and building low-income households’ resilience.

But the world is changing and MFIs need to adapt their ways of working to become more resilient and keep up with the times. The spread of digital technologies is one of the biggest shifts, requiring MFIs to come up with digital transformation strategies in order to remain competitive and grow. The COVID-19 pandemic forced MFIs to make major adjustments to how they operate in order to survive, and climate change is another force pushing institutions to evolve and build their resilience.

Through these shifts, MFIs cannot lose sight of their reason for being - their clients. A focus on their customers - on making sure that products are designed with client-centric and gender-intelligent approaches, and that services are provided responsibly with proper consumer protection measures - will help ensure their ability to withstand the impacts of climate change and other crises.

This FinDev Editor's Collection provides you with a guide to navigating the wide range of knowledge resources available for microfinance institutions looking to adapt and build resilience to a rapidly evolving world.

|

View a list of all our resources on these topics related to microfinance operations:

Audit and Accounting | Financial Performance | Governance | Human Resources | Interest Rates and Pricing | Management Information Systems | Risk Management |

View a list of all our resources on these topics related to financial products:

Credit | Housing Finance | Insurance | Islamic Finance | Payments | Remittances | Rural and Agricultural Finance | Savings |

Adapting Microfinance to a Digital World

Microfinance began in a world of low tech and high touch, with business models based on manual processes and personal interactions of MFI staff with solidarity groups. As the world goes digital, MFIs must adapt in order to survive in a much more competitive landscape that includes fintechs, mobile network operators and other players outside of the traditional financial sector who can offer faster, more convenient and more affordable access to financial services. Digital transformation can help MFIs compete with newer entrants to the market, but it can also do much more than that, helping MFIs improve how they work, use data more effectively, design better products and make processes more efficient. Ultimately, digital transformation offers a great opportunity for MFIs to reach even more low-income customers and significantly advance financial inclusion.

However, digital transformation is not easy. It requires serious investments in upgrading older management systems and rethinking ways of doing business. These changes can be expensive and complicated, making them easy to put off. The COVID-19 pandemic ended up playing a pivotal role in accelerating the digital transformation of MFIs. Faced with unprecedented challenges and disruptions, many institutions had no choice but to fast-track their digitalization efforts to survive. For some, the pandemic served as a compelling case study, demonstrating the immense benefits and efficiencies that digitalization could bring and ultimately leading to a more widespread acceptance and adoption of digital solutions.

Microfinance institutions that successfully generate value for their business and customers through digitization anchor these efforts in business intelligence. This Technical Note outlines an approach for improving business intelligence with interventions that require minimum or no investment in technology.

The role of executive leadership is key for microfinance institutions to move successfully towards the digital future.

Through real examples of implementation experiences across FSP partners, this guide unpacks six key strategies that financial inclusion-focused institutions need to keep in mind as they progress down the path of digital transformation.

ADDITIONAL RESOURCES ON DIGITAL TRANSFORMATION

- Microfinance Digitization (CGAP Collection)

- Digital Future of Microfinance: A Realistic Path Towards Big Dreams (CGAP Webinar, Jun 2023)

- MFI Digitization in Central America’s Northern Triangle: The Impact of the COVID-19 Pandemic (Paper, Financial Access Initiative, Jan 2023)

- Steven Duchatelle, CEO of Advans Group, on His Company's Digital Transformation (Podcast, Financial Due Diligence Associates, Jan 2023)

- Pitfalls in MFI Digitization: What They Are and How to Avoid Them (CGAP Blog Series, Feb 2022)

- A Case Study on Connecting With Low-income Customers Through Digitalisation (Case Study, WSBI, Aug 2021)

- Gateway Guide to Digital Transformation of Microfinance Institutions (FinDev Guide, Oct 2019)

- Charting the Customer Journey in the Digital Age (Paper, CFI, May 2019)

- Digital Transformation of MFIs in Bangladesh (Paper, UNCDF, Apr 2019)

- Changing Change Management: Adapting Internal and External Culture in Times of Digital Transformation (Guide, IFC & Mastercard Foundation, Nov 2018)

Designing Products with Clients, Especially Women, at the Center

Understanding what clients want and need in any specific market segment is essential for successful product development. It is also key for MFIs’ continued relevance as economies shift and customers’ needs evolve. To adapt to these changes and remain resilient, MFIs must keep their focus centered on the client - their reason for being.

A customer-centric approach helps microfinance institutions ensure that their products and services offer value to their clients, giving them control over their financial lives and contributing to their empowerment. Product design must give special attention to considering women’s realities, as research has shown that “gender-blind” financial services are often unintentionally biased towards men. Customer-centric and gender-intelligent product design approaches are not only good for customers, but also for the financial institutions who gain competitive advantage with increased customer loyalty and product usage.

CGAP Customer-Centric Guide

The CGAP Customer-Centric Guide is a collection of hands-on toolkits and experiments that help you design and deliver effective financial services for low-income customers.

Revolutionizing Product Design in Financial Services

This publication shares the Women’s World Banking women-centered design methodology, providing financial services providers with the knowledge and confidence to use women-centered design to develop financial products and services that truly work for women.

From Ideation to Iteration: Human-Centered Design of Micro-Savings in Nigeria

LAPO Microfinance Bank learned five important lessons from their experience using a human-centered design process to revamp their child savings account product.

ADDITIONAL RESOURCES ON CLIENT-CENTRIC PRODUCT DESIGN

- How Providers Can Build Products That Improve Financial Health: Examples From Mexico and Chile (Case Study, Accion, Dec 2021)

- Data-Driven Segmentation in Financial Inclusion (Guide, CGAP, Aug 2019)

- Taking Human-Centered Design from Theory to Practice: UGAFODE’S AirSave Considerations for Financial Service Providers (Case Study, UNCDF, Apr 2018)

- Card Pioneer's Journey to Customer Centricity (Video, CGAP, Sep 2018)

- Leadership and Organizational Culture in Customer Centricity: The Journey of AMK Cambodia (Case Study, CGAP, Jun 2018)

- At the Heart of All That We Do: Janalakshmi’s Journey to a Customer-Centric Bank in India (Case Study, CGAP, Jun 2018)

ADDITIONAL RESOURCES ON GENDER-INTELLIGENT DESIGN

- Informed Design: A Case Study Series (Case Studies, FinEquity, Aug 2022)

- FinEquity Knowledge Guide: Incorporating Gender-intelligent Design in Financial Services (FinEquity Guide, Jul 2022)

- The Financial Agency of Women (Slide Deck, IDEO.org & Bill and Melinda Gates Foundation, Mar 2019)

- Acquisition and Engagement Strategies to Reach Women With Digital Financial Services (Paper, Women’s World Banking, Feb 2019)

Providing Financial Services Responsibly

Most microfinance institutions have some kind of social mission, with a focus on low-income and vulnerable customers. However, we know that financial services, especially loans, can carry risks for clients, and those risks can be particularly severe for people who live at poverty’s edge. With the advance of digital finance, financial consumer risks are growing and evolving. MFIs must adapt by ensuring that they have systems in place to protect their clients and ultimately, help their clients to thrive.

Client Protection Pathway

The Client Protection Pathway describes the steps that a financial service provider can take to implement the client protection practices necessary to avoid harming clients and communicate this progress to investors. The Pathway gives providers a roadmap for implementing the Client Protection Standards and helps them stay on track.

The Universal Standards for Social and Environmental Performance Management

A comprehensive manual of best practices, the Universal Standards help financial service providers put clients and the environment at the center of all strategic and operational decisions, and they show financial service providers how to align their policies and procedures with responsible business practices.

An Ecosystem Approach to Consumer Protection: What, Why and How?

CGAP believes that a responsible digital finance ecosystem approach is the way forward to deal with evolving and growing financial consumer risks. Its success rests on involving key ecosystem actors, building up capacities, and fostering collaboration to identify consumer risks and develop customer-centric solutions, policies and services that result in financial services that generate good customer outcomes.

ADDITIONAL RESOURCES ON RESPONSIBLE PROVISION OF FINANCIAL SERVICES

- Embedding Trust: The Potential of Privacy by Design for Inclusive Finance (Paper, CFI, Dec 2022)

- How are Mobile Money Agents Protecting Customers’ Data in Uganda? (CGAP Blog, Dec 2022)

- Building Cyber Resilience for Digital Financial Inclusion and Innovation (Guide, Accion, May 2022)

- Social Investors’ Message on Client Protection: “Financial Service Providers Don’t Have to Do It Alone” (FinDev Blog, Oct 2021)

- The UN Principles for Responsible Digital Payments (Guide, Better Than Cash Alliance, Jan 2021)

- Client Protection in Middle East and North Africa (Paper, IFC, Jan 2019)

- Responsible Digital Credit: What Does Responsible Digital Credit Look Like? (Paper, CFI, Jul 2018)

- Tiny Loans, Big Questions: Client Protection in Mobile Consumer Credit (Paper, The Smart Campaign, Sep 2017)

- Customer Empowerment in Finance: Why Greater Choice and Control for Poor Customers is Better for Business and Will Help Achieve Financial Inclusion (Guide, CGAP, Aug 2017)

- Loan Officers and Clients’ Over-Indebtedness Prevention: The Case of Banco Adopem (Case Study, Savings and Development, Dec 2015)

Building Institutional Resilience to Respond to Crises

Climate change, natural disasters, pandemic, war. The world is in flux and microfinance institutions need to be agile and resilient in order to survive and help their clients thrive. With their direct link to low-income populations, MFIs are in a good position to help build individual and collective resilience for managing the impacts of climate change and other challenges. But the institutions must first be resilient themselves in order to help their clients build their own resilience. The pandemic taught us many lessons on the importance of institutional adaptation and flexibility that can help MFIs as they navigate the environmental and economic changes from climate change and other crises.

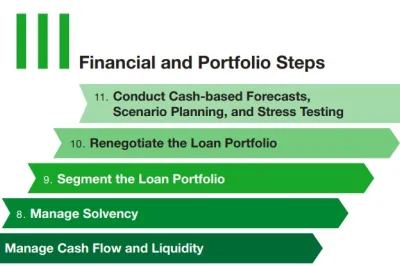

This publication shares lessons learned from 16 institutions that dealt with crises, framed by a four-part hierarchy of needs: liquidity, confidence, portfolio, and capital.

Steps microfinance institutions can take to navigate the pandemic and prepare for future crises

ADDITIONAL RESOURCES ON RESPONDING TO CRISES

- In an Era of Urgent Climate Risk, Does Financial Inclusion Matter? (CGAP Blog, Jun 2022)

- Growth Pangs of the Pandemic, Revisited (Paper, M-CRIL, May 2021)

- Savings and Retail Banking in Africa: A Case Study on Innovative Business Models (Case Study, WSBI & Mastercard Foundation, May 2021)

- Best Practices in Credit Risk Management in Times of Crisis (Paper, MicroRate, Feb 2021)

- After the Storm: How Microfinance Can Adapt and Thrive (CGAP Blog, Oct 2020)

- Adapting to a New Normal (Paper, e-MFP, Jul 2020)

- Responding to the COVID-19 Pandemic: Guidance for Financial Service Providers (Guide, Accion, Mar 2020)

- Financial Inclusion and Resilience: How BRAC’s Microfinance Program Recovered from the West Africa Ebola Crisis (Case Study, Global Delivery Initiative, Jul 2017)

- First Microfinance Institution Syria: Building Resilience Through a Client-Centric Model (Case Study, Aga Khan Agency for Microfinance & The SEEP Network, Sep 2016)

- Disaster-Resilient Microfinance: Learning from Communities Affected by Typhoon Haiyan (Paper, VisionFund International & Asian Development Bank (ADB), May 2016)

- Microfinance in Post-disaster, Post-conflict Areas & Fragile States: Resilience and Responsibility (Paper, e-MFP, Apr 2016)

- External Risks: Contingency Planning Guide for Microfinance Institutions in Sierra Leone (Guide, Cordaid, Ayani & Sierra Leone Association of Microfinance Institutions, Dec 2015)

View a list of all our resources on these topics related to microfinance operations:

View a list of all our resources on these topics related to financial products: